What is the Education Loan Deduction Limit Under Section 80E. Even if an individual has availed the maximum available deduction of INR.

Section 80e Tax Concession On Education Loan

Yes you can claim deduction under section 80E even if your child is going abroad for higher education and it includes both vocational as well as regular courses.

80e education loan limit. So can I get deduction under 80E. Section 80 E Calculator. I want to avail higher education loan for my child who is going to study in abroad.

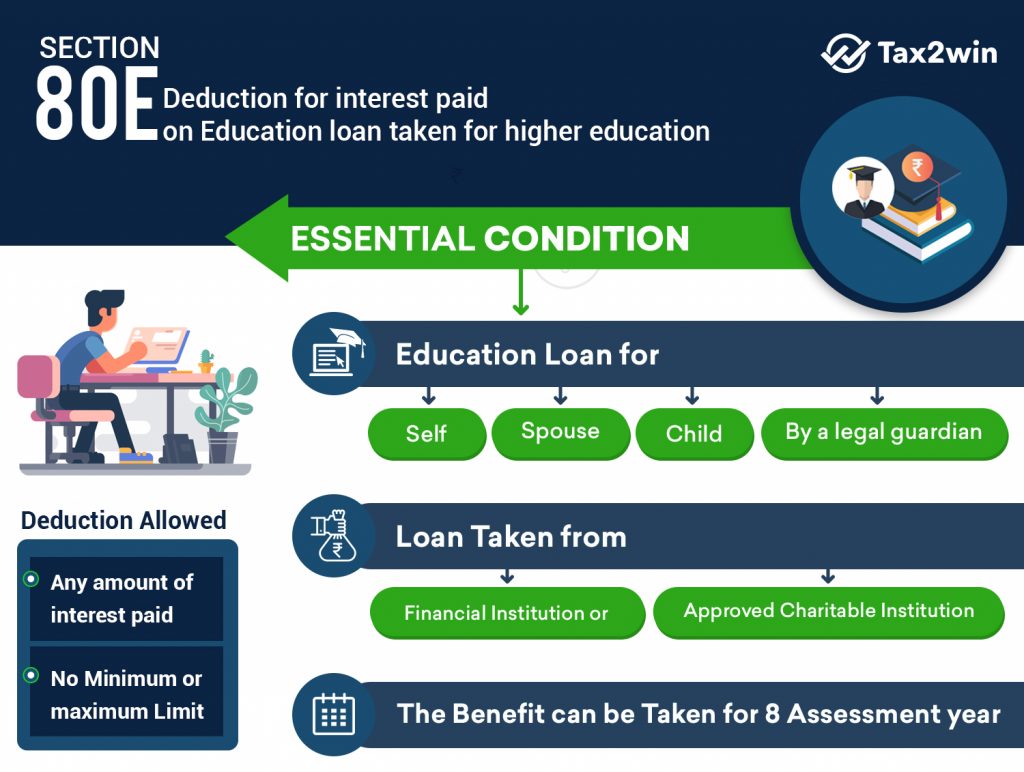

The deduction under section 80E for Interest on educational loan is available to an individual if following conditions are satisfied. However if a borrower chooses to pay instalments during these periods limit of 8 years will start from the year of 1 st payment. Education you deserve check your eligibility today.

Who can claim the tax benefit under Section 80E. This 8 year is counted from the date of repaying the loan. The education loan interest would be deducted under section 80E which is in addition to 80C 15 lakh limit.

Also there is no upper limit of the rate of interest which will be allowed as a deduction. Ad Finance the US. There is no maximum limit for claiming the deduction under Section 80E.

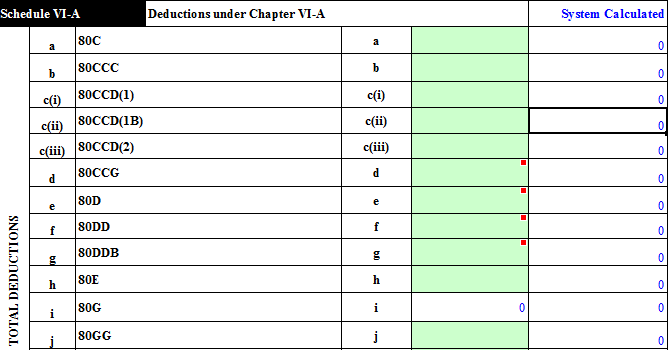

There is no limit on the maximum amount which is allowed us 80E. So in your case the tax exemption under section VI would be 172000. Who is eligible for Section 80E Deduction for educational loan Section 80E Deduction for educational loan available only to Individual not to HUF or other type of Assessee.

Education loan is a must and it has its advantages but you dont have to burden your child with debt if you start investing with a financial goal. You can claim the total amount paid as interest on an education loan for the financial year. Such period should be excluded for calculating 8 years limit.

A co-applicant can use this provision to avail tax exemptions only for a period of 8 years after the course is over. Deduction in respect of interest on loan taken for higher education. Usually education loan has moratorium period ie period during which instalments are not to be paid.

Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961. Bare act portion of the provision. According to Section 80E the education loan applicant or the co-applicant may avail of the education loan income tax exemption.

Read for eligibility no limit loan period purpose benefit and much more. There is no upper limit for grant of deduction in respect of interest on loan for higher education. The entire interest amount on your education loan is eligible for deduction regardless of how much it is.

What is the maximum limit under Section 80E. Sec 80E provides deduction on interest paid on loan taken for higher education in India or abroad. This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier.

Deduction for interest on educational loan us 80E The maximum amount of deduction allowed under section 80E Interestingly provided assessee fulfills all the specified conditions stated above there is no limit on the amount of deduction the assessee can claim the whole amount of interest paid on such loan as a deduction under section 80E. Read about Sec 80E Deduction for ineterst paid on education loan for 8 years. Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961.

Ad Finance the US. Deduction amount under Section 80E. In this case the father is eligible for an exemption.

There is no maximum or upper limit for deduction against interest on education loan under section 80E. There is no upper limit on the deduction that can be claimed under Section 80E. Under this section only interest amount on educational loan will be allowed principal amount will not be allowed.

Section 80E education loan tax benefits are only allowed for a maximum period of 8 years. There is no monetary limit us 80E. 150000 under section 80C they can still avail deduction under Section 80E.

Education you deserve check your eligibility today. There is no limit on the maximum amount which is allowed as deduction. Lets assume that you have taken an education loan of Rs 10 lakh on which you are paying annual interest of Rs 1 lakh.

One has to note that a deduction is available only for 8 consecutive years. 1 In computing the total income of an assessee being an individual there shall be deducted in accordance with and subject to the provisions of this section any. An individual can claim the total interest amount paid as a deduction.

Under section 80E the deduction amount that can be claimed by individual for higher education loan will be 100 of total amount of interest.

Financial Mile Good Evening Guys Section 80e Deals With Facebook

Income Tax Deduction On Repayment Of Education Loan Section 80e Youtube

Financial Mile Good Evening Guys Section 80e Deals With Facebook

Interest On Education Loan Smart Paisa

Save Tax On Education Loan Interest Under Section 80e Sag Infotech

Under Section 80e You Can Claim Income Tax Deduction For Interest Pai

Section 80e Education Loan The Mantra To Save Tax

How To Apply For Deductible Interest On An Education Loan Under Section 80e Quora

Section 80e Income Tax Deduction For Education Loan Indiafilings

Deduction U S 80e Interest On Education Loan By Munimji Training And Placement Academy Issuu

Section 80e Deduction For Interest On Education Loan Tax2win

Section 80e Income Tax Deduction On Education Loans

Details Of Section 80e Deduction On Education Loan Yadnya Investment Academy

Section 80e Deduction Interest On The Educational Loan

Deduction U S 80e Interest On Education Loan

Section 80e Deduction Of Income Tax Or Interest On Education Loan

Section 80e Education Loan The Mantra To Save Tax

Section 80e Income Tax Deduction On Education Loan

Income Tax Deduction For Interest On Education Loan Section 80e Taxadda

0 comments